We have significant combined real estate investment experience and know the exact history and track records of the top DST sponsors, asset management firms, and property developers. Our goal is to assist clients in accumulating wealth through a tax-deferred, diversified investment strategy that balances returns with acceptable levels of risk. Unlike many DST registered representatives, we fully advise our clients on all tax and legal issues pertaining to their exchange transactions and guide them through the entire 1031 exchange process. We share our extensive investment experience and property analysis research with our clients throughout the asset selection process. The following information explains how the DST structure works and how investors can benefit from a 1031 exchange.

What is DST?

A DST (Delaware Statutory Trust) is a Delaware-based legal trust in which each investor holds a beneficial interest. Each investor is recognised as possessing an undivided fractional interest in the property for federal income tax purposes. Under IRS Revenue Ruling 2004-86, DSTs qualify as replacement properties for 1031Exchanges. While the DST has been around for decades, they were not employed for 1031 purposes until 2004, when the IRS issued a revenue ruling. Since then, as more real estate investors grasp the benefits of DSTs, demand has surged. The DST is the preferable structure for purchasing management-free real estate through a 1031 exchange due to current tax legislation. DSTs are a good option for real estate investors who want to get out of management while still benefiting from the tax deferral benefits of a 1031 exchange. DST properties provide advantages over other types, including reduced investment minimums, diversity, ease of financing, and potentially higher cash flow and appreciation. DST properties allow investors to own a portion of a bigger income-producing property for as little as $100,000 and reap all of the benefits of property ownership without the hassles of property administration.

How DST Works?

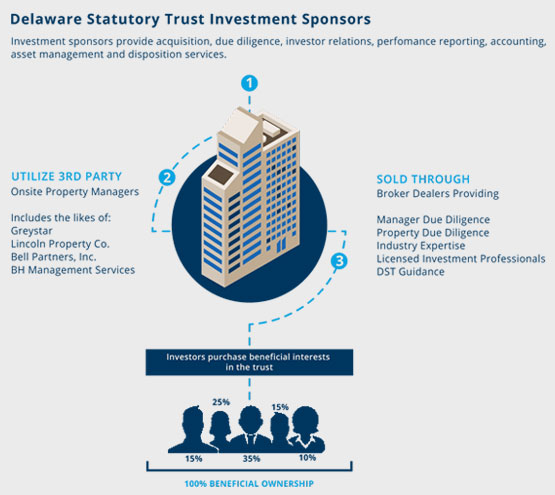

A sponsor is a real estate corporation that buys a specific property that is structured under a newly created DST. Most individual real estate investors would be unable to purchase such huge institutional-grade properties on their own.

Apartment complexes, office buildings, NNN properties, assisted living, self-storage, medical offices, student housing, industrial buildings, and even golf courses are all purchased through a DST. After the property is purchased, investors are offered DST interests, which are sold through secondary escrow closings until the DST’s equity is sold. Cash flow dividends are paid to investors on a monthly basis based on their ownership interest.

The sponsor provides investors with a Year-End Operating Statement every year that includes all of the information they need to report their income, deductions, and depreciation to balance their taxes, including valuation. DSTs are bought for the purpose of completing a 1031 exchange and then sold for a profit in the future. DSTs are often sold seven years after purchase, but this varies depending on the property and market conditions. Each investor receives their proportionate part of the net sales revenues when the property sells.

Investors have the option of taking the cash proceeds or doing another 1031 exchange to continue deferring their taxes.

DST Key Benefits

Tax savings, income potential, the ability to purchase ownership in an institutional-quality asset, and, perhaps most importantly, DSTs are eligible for 1031 exchanges are just a few of the perks of DST ownership.

By distributing their 1031 exchange proceeds over many institutional-grade DST properties that are often significantly larger and out of reach of most individual investors, DSTs stand out as a 1031 replacement property option for investors seeking passive income potential and diversified risk.

DST and 1031 Exchange

Statutory Trusts in Delaware for 1031 Exchanges

A 1031 Exchange is a transaction allowed by the IRS that allows real estate investors to delay tax responsibility or capital gains taxes on the sale of investment property. It is called after Section 1031 of the United States Internal Revenue Code. DSTs qualify for tax-deferred 1031 Exchanges since they are deemed direct property ownership for tax purposes. To avoid paying taxes, the proceeds from the sale of the relinquished property must be invested in a “like-kind” replacement property of equal or better value within 180 days of the relinquished property’s closing date.

The 1031 Exchange Basics are the same for all property types, including DSTs. DSTs, on the other hand, normally close 3 to 5 business days after the sale of the surrendered property, which is a substantial advantage when compared to the rigorous 1031 exchange requirements and timelines.

How to Find DST Properties to Invest

DST Sponsors are national institutional real estate firms in charge of screening, acquiring, and maintaining the properties included in each. Delaware Statutory Trust they propose. Following the purchase of the DST property, a variety of parties conduct due diligence on the property and trust structure. The DST sponsors package the DST offering for investors and advertise it through independent brokers who have the requisite securities licence to conduct DSTs on behalf of their clients.

A DST can own one or more properties, and each DST will typically own only one sort of property. DSTs typically possess high-quality institutional property, which has the potential for higher income and appreciation. One DST would own a portfolio of class A multifamily apartments, while another might own an Amazon Distribution Centre or net lease real estate with corporate assured retail tenants like Walgreens or Whole Foods.

The most difficult aspect of investing in a DST may be locating one. Because of SEC regulations, not all DST investments can be sold directly to the public. To make offerings available to accredited investors, DST sponsors work directly with securities brokers-dealers and 1031 Exchange Advisors. Our licenced 1031 Exchange Advisors at Real Estate Transition Solutions diligently analyse all DST sponsors and offerings to ensure investment options presented align with our clients’ objectives.

DST Advantages

Know the key advantages of DST

The ability to defer, reduce, or even eliminate taxes associated with the sale of investment property via a 1031 Exchange is perhaps the most compelling reason to invest in a Delaware Statutory Trust. DSTs are also a popular passive real estate investment, as they provide ownership in institutional-quality properties while requiring minimal landlord responsibilities. As 1031 Exchange replacement properties, Delaware Statutory Trusts have several advantages:

Tax Breaks for Capital Gains

With a 1031 exchange, DSTs qualify as a like-kind property. This enables real estate investors to postpone paying capital gains taxes on the sale of an investment property, which can result in significant savings. Capital gains taxes, which include the federal capital gains tax, state capital gains tax, depreciation recapture tax, and net investment income tax, can be as high as 42.1 percent in some states.

Increased Earning Potential

DST properties are typically structured with a focus on cash flow. DSTs can focus on preserving investment value and increasing income potential for investors by acquiring high-quality institutional property in cities with strong projected growth. The monthly income varies depending on the property type and investment thesis, but independent investors may be able to generate more monthly income through DST property ownership than through direct property ownership.

Properties of Institutional Quality

Although a DST can own nearly any type of real estate asset, the underlying real estate held by DSTs is typically high-quality institutional property. Institutional-grade properties are those that are large and significant enough to attract the attention of large national or international investors, and they typically have the characteristics of high-quality assets in major markets at prices that are out of reach for individual investors and smaller partnerships.

Lower-quality assets are rarely eligible due to the IRS’s strict criteria for a DST to qualify as an exchange property. As a result, DSTs frequently own high-quality assets with credit-worthy Fortune 1000 tenants. These properties would be unattainable for an independent investor to purchase via a 1031 exchange if not for the DST structure.

Management of Passive Property

DSTs are considered passive investments. As a result, individual investors have no involvement in the DST real estate’s day-to-day management or operations. Your work is finished once you choose a DST investment and acquire ownership. Investors can use a 1031 exchange to exit a management-intensive asset and avoid landlord responsibilities while still reaping the benefits of owning investment real estate. This is a particularly appealing benefit for independent investors who are about to embark on major life changes, such as retiring, starting a family, or planning an estate transfer.

Diversification of Risk

DSTs have a low minimum investment requirement, typically $100,000, making it simple to diversify across multiple assets to help mitigate risk. Investors can reinvest the proceeds of an investment property sale into multiple DSTs under the IRS’s property identification rules for 1031 exchanges, creating immediate investment diversification among different DST property types and locations.

Estate Beneficiaries Can Save Money on Taxes

DSTs can also help with estate planning. Beneficiaries can defer capital gains, depreciation recapture, and net investment income tax upon the death of an owner by using a step-up in basis. A DST investment can also be divided seamlessly among beneficiaries by the estate, which is not always possible with traditional, directly-owned fee simple real estate assets.

A CPA can discount a DST investment when calculating the value of the total estate because it is an illiquid investment with fractional ownership. It is not unusual to see discounts ranging from 20% to 30%, which can help to reduce potential estate taxes.

Exchange Failure Probability is Low

Because the real estate has already been vetted and acquired by the DST sponsor, DST exchanges rarely fail. Using a reputable 1031 Exchange Advisor reduces the likelihood of a failed exchange. All DST sponsors and DST properties are thoroughly vetted by Real Estate Transition Solutions. We believe that a quality-control process and higher-quality investment opportunities help to reduce the risk of a failed 1031 exchange.

Capability to complete in 3 to 5 days

Due to the fact that the DST Sponsor has already acquired the properties within a Delaware Statutory Trust, investors can purchase beneficial interests in the trust more quickly than with many other replacement property options. This is ideal for a time-sensitive 1031 Exchange or for investors who value income continuity because DST investors can typically close within 3 to 5 business days of selling their relinquished property.

Drawbacks of a Delaware Statutory Trust

Investing in Delaware Statutory Trusts, like all real estate investments, carries many of the same risks, including potential loss of return and principal. DST performance is heavily reliant on the tenants’ ability to pay rent as a long-term, income-focused investment. This creates a number of notable DST risks, such as a lack of liquidity, interest rate risk, and changing market conditions. Furthermore, some of the characteristics of a DST, such as the lack of personal control over the investment, may be incompatible with an individual’s investment objectives.

Inadequate Management Control

A lack of management control can be advantageous as well as disadvantageous. After all, one of the characteristics that makes a DST so appealing as an investment option is its passive nature. To manage DST operations, the DST Sponsor assembles a highly experienced team of real estate professionals. Some investors, on the other hand, prefer to be involved in the property strategy and operations. The DST structure would not be a good fit for those investors.

Insufficiency of Liquidity

DST properties are typically held for a period of three to ten years. The DST sponsor has complete control over the investment’s duration and exit. The only way for an investor to exit early is to sell the DST interest to another accredited investor. The sale would also be subject to the same 1031 exchange guidelines, or the investor would be liable for any capital gains taxes owed on the sale. It should be noted that some DSTs include liquidity through a 721 UpREIT.

Changes in Rates and Regulations

Investors may be subject to future vacancy rates and interest rate fluctuations, as with any type of income-oriented real estate investment, which could reduce cash flow potential and price appreciation. Changes in the IRS’s treatment of tax-deferred exchanges may also affect DSTs.

Registered Representative

representatives who work directly with clients, analyse properties, research markets, examine locations and demographics, and stay up to date on all tax, securities, and legal regulations.