A 1031 exchange can prove to be very helpful if you are in possession of an investment property and have thoughts about selling it and buying another property; then this is a tax method that allows investors to defer paying taxes on the sale of an investment property for as long as they desire. It is a method that lets you sell and buy like-kind properties while deferring capital gains tax.

While a 1031 exchange can be a wise strategy to employ, the reality is that they are rather complicated, and investors should familiarize themselves with the requirements before attempting to perform one. This article focuses on the basics of 1031 exchanges and specific rules, restrictions, and examples to keep in mind.

What is 1031 Exchange?

A 1031 exchange is a type of a transaction in which one investment property is exchanged for another permitted by Section 1031 of the Internal Revenue Code. It allows you to defer capital gains taxes when you sell an investment property as long as the proceeds are used to make a similar investment within a specific time frame. The term “1031 exchange” comes from Section 1031 of the Internal Revenue Code, according to which when you sell an investment property and reinvest the proceeds within specific time constraints in a property or properties of like kind and equal or greater worth, you can avoid paying capital gains taxes.

What is Tax Deferral?

Tax deferral is when a taxpayer postpones paying their taxes until a later date. Some taxes can be postponed indefinitely, while others may be taxed at a lower rate later. Individual taxpayers and corporations can delay certain taxes; overseas corporate proceeds can also be deferred.

Any proceeds received through the sale of a property are still taxable under section 1031. As a result, the proceeds of the sale must be transferred to a qualified intermediary, who subsequently transfers them to the seller of the replacement property or properties, rather than the seller of the original property. A qualified intermediary is a person or company who agrees to help with a 1031 exchange by keeping the cash until they transfer it to the replacement property seller. There can be no other formal relationship between the qualified intermediary and the parties exchanging property.

Why consider 1031Exchange?

There are several reasons why a 1031 exchange can benefit you as an investor. Some of them are mentioned below:

However, it’s worth noting that a 1031 exchange may require a sizable initial expenditure and a longer holding time, which makes high-net-worth individuals more interested in these trades. Because of their complexity, 1031 exchange transactions should be handled by professionals.

Rules to keep in mind while performing a 1031 Exchange

3-Property Rule

The 3-property rule specifies that replacement property identification can be made for up to three properties during the first 45 days of the exchange, regardless of the total value. The taxpayer can identify and purchase up to three replacement properties after relinquishing their original property. To avoid frequent hazards associated with the receipt of excess money and the early release of funds, a qualified intermediary often demands that taxpayers declare how many replacement properties they intend to acquire.

200 Percent Rule

Even if a taxpayer identifies more than three properties, the 200 percent criterion allows them to complete a lawful trade. The 200 percent rule stipulates that a taxpayer may locate and close on multiple properties as long as those properties’ total fair market value does not exceed the relinquished property value. Using the listing price to determine a property’s fair market value is usually a safe bet.

95 Percentage Rule

The 95 percent value comes into play if the taxpayer has violated both previous requirements by designating more than three properties with a combined worth of more than 200 percent of the relinquished property value. The 95 percent rule states that if a taxpayer purchases at least 95 percent of what they identified through the exchange, their identification is still legitimate after failing the first two requirements.

Who is Eligible for 1031 Exchange?

Property owners can defer taxes on the sale of real estate held for business or investment purposes under Section 1031 of the tax law. The only condition for someone or something to be eligible for an exchange is to be a tax-paying entity in the United States. Individuals, partnerships, limited liability companies, S corporations, C corporations, and trusts are eligible taxpayers. There are no citizenship requirements for an exchange, which means anybody can participate as long as you pay US taxes. DACA recipients and international corporations are subject to this rule. It’s important to remember that the taxpayer who sells the surrendered property must also buy the replacement property.

The exact taxpayer requirement refers to tax identification rather than the name on the property’s title. Holding title under a “tax ignored entity,” which is not deemed different from its owner for tax reasons, allows a taxpayer to maintain their tax identity while not holding ownership under their name. A tax ignored entity is a single-member LLC, a trustee of a revocable living trust, or a tenant in common.

An Exchanger is a term used to describe a person who trades one thing for another. Individual or entity seeking a transaction. A Delaware Statutory Trust (DST) or an Illinois Type Land Trust beneficiary can also hold title. If tax-deferred exchange conditions are met, and the sale profits are reinvested in like-kind property, the tax gain can be postponed.

Understanding Like-Kind Property

According to the IRS, the property or properties you buy in a 1031 exchange must be “of the same nature or character” as the property you sell.

This does not imply that you must purchase the same type of property. A duplex does

not have to be “exchanged” for another duplex, and an office building does not have to be “exchanged” for another office building, and so on.

This implies that you purchase a property (the replacement property) intending to hold it as an investment.

To put it another way, you can’t sell an investment property and buy a vacation home for yourself and your family while calling it a 1031 exchange. However, if both assets are meant to be used as investment properties, you can sell a single-family property and buy a retail structure.

To be clear, there is a distinction between a home you intend to hold as an investment and one you purchased to sell for a profit. While there are no particular requirements for how long you must retain property in order to use it in a 1031 exchange, the rule of thumb is that if you bought it as a fix-and-flip or sold it for a significant profit soon after you got it, it is unlikely to be a candidate for a 1031 exchange.

The following are some examples of real estate interests that can be exchanged for any real estate:

Commercial real estate

Rentals for several families

Vacant properties

Rentals for single-family homes

Vacation rentals (Airbnb / VRBO)

Land for farming and ranching

Improvements to property that is not currently owned

Mineral interests include oil, gas, and other minerals.

Water rights are essential.

Easements for cell towers, billboards, and fiber optic cable

Easements for conservation

DSTs (Delaware Statutory Trusts)

Easements for conservation

Property Exchange Requirements (1031 Exchange Requirements)

A sale followed by a purchase does not qualify as a 1031 exchange. Section 1031 of the Internal Revenue Code states that “no gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or investment if such property is exchanged solely for property of like-kind which is to be held for effective use in a trade or business or for investment if such property is exchanged solely for property of like-kind which is to be held for productive use in a trade or business 1031 Exchange. For tax reasons, the transaction must be recognized as an exchange. A property owner will hire a qualified intermediary (QI) to operate as a middleman and tie the sale to a buyer and the purchase from a seller as a verified exchange to transform a sale followed by purchase into an exchange.

In the case of a forward exchange, the taxpayer must contact the QI before closing the initial sale, and in the case of a reverse exchange, the taxpayer must contact the QI before closing the initial purchase. The QI will need your Exchange Documents to start an exchange, which includes:

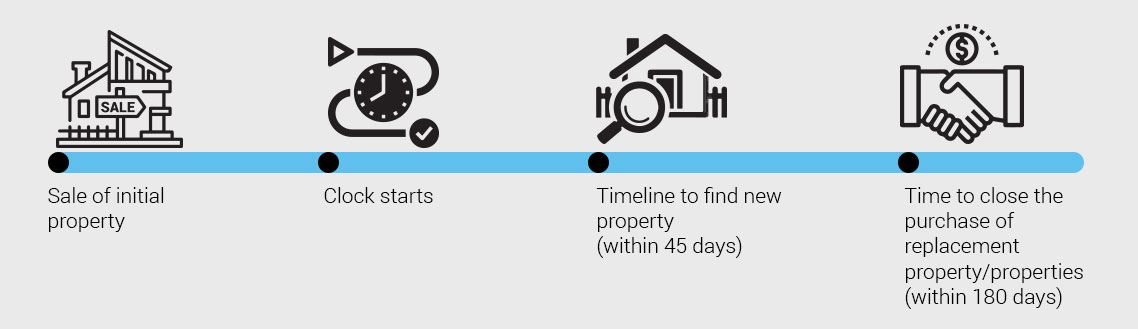

Important Timelines

1031 Exchange: Forward or Deferred

Before any sales transaction, the taxpayer and the qualified intermediary (QI) draw up an exchange agreement in a forward 1031 exchange. The taxpayer transfers to the QI their right to sell the relinquished property. The QI will function as the property’s seller and hold the funds in an exchange account for the taxpayer’s benefit. During the first 45 days of the exchange, the taxpayer has the opportunity to identify suitable replacement property. The rights to acquire a replacement property are assigned to the QI once a replacement property has been chosen. The taxpayer must close within 180 days of the relinquished property’s closing date.

1031 Reverse Exchange

When taxpayers buy their replacement property before selling their surrendered property, they do a reverse exchange, also known as a parking exchange. When a forward exchange is serviced, the exchange company operates as a qualified intermediary (QI). When a reverse exchange is performed, the exchange corporation gains title to a property (typically the replacement property) through a specifically constituted entity, usually a single-member LLC. An exchange accommodation titleholder is what it’s called (EAT). The taxpayer first enters into a contract to purchase the replacement property, and then with the entity acting as the EAT, the taxpayer enters into a reverse exchange agreement.

Steps for 1031 Exchange

Completing a successful and IRS-compliant 1031 exchange entails a lot of work. Here’s a consolidated list of the general steps of a conventional (delayed) 1031 exchange to try to make things a little easier for you:

Who can help you with 1031 Exchange?

Real estate agent — If you’re an experienced real estate professional, you might be able to sell and acquire the properties without the services of a real estate agent. However, most people should hire one, especially one specializing in 1031 exchange replacement properties.

Exchange facilitator — As previously stated, a 1031 exchange cannot be completed totally on your own. To make the transaction go well, you’ll need an intermediary.

Attorney or tax advisor — One of the most important conclusions from this discussion is this: A 1031 exchange is a complicated tax method, and there are some instances where there may be some murky area. It’s critical to understand that even if you hire an excellent skilled intermediary, their responsibility is not to provide tax advice. As a result, having an experienced tax professional to advise you through the 1031 exchange process and the process of submitting your tax return once the exchange is complete is critical.

In the end, a 1031 exchange can be an effective tax strategy for experienced real estate investors, but it’s not an easy process. Before you undertake a 1031 exchange in your portfolio, be sure you understand the process and obtain the advice of knowledgeable and experienced professionals.

Canceling the 1031 Exchange

It is possible to cancel an exchange, although the cost and timing differ from facilitator to facilitator. The problem with exchange termination is the concept of constructive receipt, and the taxpayer must not have actual or constructive receipt of the exchange profits under Section 1031. The exchange mechanism may not be defendable if a taxpayer can request and receive payments at any moment.

As a result, an exchange can be terminated at any of the following times:

Any time before the relinquished property sale closes.

After the 45th day, and only after you’ve bought all of the property, you’re allowed to under Section 1031 requirements, you can sell it.

After the 180th day has passed.

1031 Exchange- FAQs

What are some important Timelines for the 1031 Exchange?

Identification requirements: By midnight on the 45th day, the investor must have identified the replacement property. In most cases, the investor chooses three potential properties of any value and buys one or more of them within 180 days. A common address or a clear description will usually be enough. If the investor requires more than three properties, they should talk with their 1031 facilitator.

What difficulties can I face while doing 1031 Exchange?

Choose up to three properties of any value that you want to buy at least one of them.

Identify at least three properties with a combined worth of no more than 200 percent of the relinquished property’s market value.

Identify at least three properties worth more than 200 percent of the relinquished property, with the understanding that 95 percent of the market value of all properties must be acquired.